Trump Signals Willingness for Negotiations After Raising China Tariffs to 125%

China's retaliatory 84% tariffs on US imports come into effect. China Has Readied a Trade-War Arsenal That Takes Aim at U.S. Companies.

Stocks surge as Trump announces 90-day tariff pause — as it happened

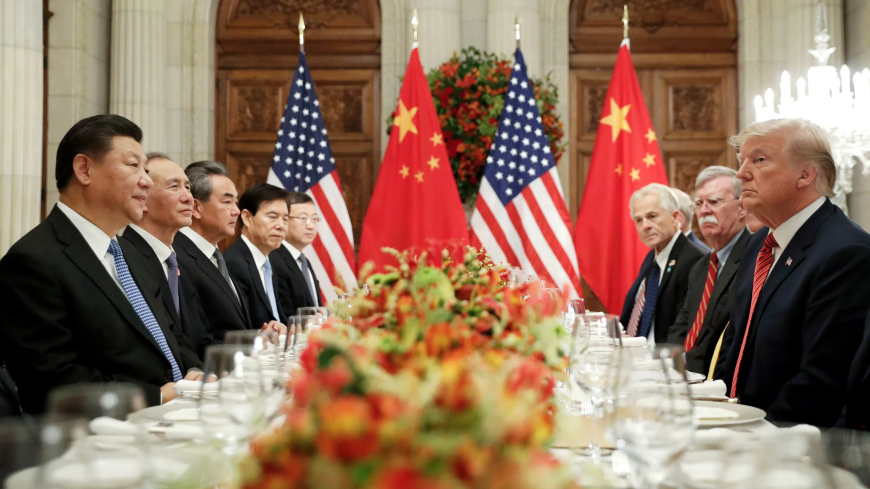

In a surprising development, U.S. President Donald Trump has expressed openness to negotiations with China just hours after imposing a 125% tariff on Chinese imports. This tariff increase, announced on April 9, 2025, marks one of the most significant escalations in the ongoing U.S.-China trade war, with far-reaching consequences for global markets and international trade relations.

U.S. Tariff Hike: A Strategic Move or a Negotiation Tactic?

The decision to raise tariffs from 104% to 125% is seen as a move to pressure China into making concessions on trade practices, intellectual property rights, and market access. The Trump administration has long accused China of unfair trade practices, forced technology transfers, and currency manipulation.

Despite the sharp increase in tariffs, Trump signaled a willingness to engage in discussions, stating:

"We are open to talks, but China needs to come to the table with real solutions."

This statement suggests that the tariffs may be part of a broader negotiation strategy rather than a purely punitive measure.

China’s Potential Response to the 125% Tariff

Following the tariff hike, analysts expect China to retaliate with its own countermeasures, which could include:

-

Higher tariffs on U.S. goods such as soybeans, aircraft, and semiconductors

-

Export restrictions on rare earth minerals, which are critical for U.S. technology and defense industries

-

Increased scrutiny on U.S. companies operating in China, potentially blacklisting major American firms

Previously, China responded to U.S. tariff increases with an 84% tariff on U.S. imports, as well as restrictions on select American companies. If tensions continue to escalate, a full-scale trade war could further disrupt global supply chains and economic stability.

Impact on Global Markets and Trade

The latest escalation has already triggered volatility in global markets:

-

Stock markets in Asia and Europe experienced sharp declines, with the Hang Seng and Nikkei indexes losing ground.

-

The Chinese yuan weakened, reflecting investor concerns over economic slowdown risks.

-

Safe-haven assets such as gold and the Japanese yen saw increased demand.

The U.S. tariffs are expected to increase costs for American businesses and consumers, particularly in industries reliant on Chinese imports, such as electronics, textiles, and auto manufacturing.

Could Negotiations Ease Tensions?

Trump’s statement about being open to talks provides a glimmer of hope for diplomatic resolution. However, for negotiations to progress, both countries will need to find common ground on key trade disputes, including:

-

Tariff reductions on both sides

-

Stronger protections for intellectual property

-

Greater market access for American firms in China

-

Reduction of subsidies for Chinese state-owned enterprises

Trade experts warn that a stalemate could prolong economic uncertainty, affecting businesses and investors worldwide.

While tariff wars can escalate global tensions and economic conflicts, they are unlikely to directly cause World War 3. However, prolonged trade disputes between major powers can lead to severe economic disruptions, political instability, and strained diplomatic relations.

Historically, economic conflicts have contributed to geopolitical tensions, as seen before World War 2 when trade restrictions and economic sanctions fueled hostilities. If tariff wars continue unchecked, they could deepen divisions between nations, disrupt global supply chains, and even lead to military confrontations in extreme cases.

To prevent such outcomes, countries must focus on diplomatic negotiations, fair trade policies, and international cooperation. The key to global stability lies in dialogue and mutual economic benefits rather than prolonged economic warfare.

Conclusion: What’s Next for U.S.-China Trade Relations?

With tensions at an all-time high, the coming weeks will be crucial in determining whether the U.S. and China can return to the negotiating table or if the trade war will escalate further. While Trump’s willingness to negotiate is a positive sign, it remains to be seen whether China will reciprocate or retaliate.

For now, the global economy watches closely, bracing for the potential consequences of one of the most intense trade conflicts in modern history.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0